There’s lots to digest in this week’s trucking economic report. Motive says that industry exits in the U.S. are now reaching into the realms of larger-sized fleets, affecting operations with five trucks or more. To date, it’s predominantly been single-truck operators that have packed it in or rejoined partnerships with larger fleets.

Meanwhile, those relying on the spot market for loads are reaching a “critical point”, and a recent survey found that 10% of those who rely on it are considering exiting the market in the next six months. Labor trouble is brewing at the Big 3 automakers, too.

Despite the gloomy outlook, ACT Research says a stubbornly strong economy is prompting its analysts to once again up their outlook for truck and trailer output.

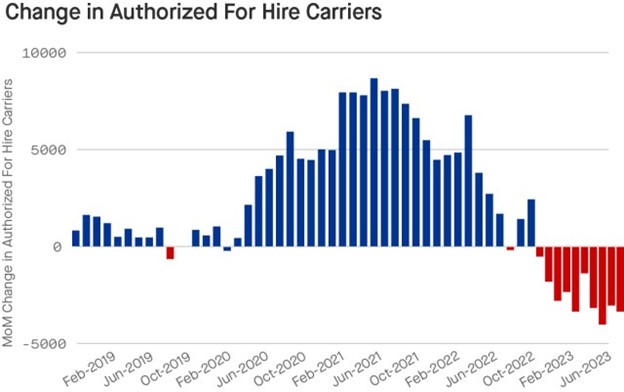

Trucking exits extending to larger fleets

Some interesting insights from Motive, a telematics company, illustrate the freight recession’s impact on the exits of larger trucking companies, beyond the onesies and twosies we’ve seen exiting the market to date.

The percentage of fleets with five or fewer vehicles exiting the market fell by 5%, according to its monthly report, indicating more exits were coming from mid-sized-to-larger fleets than we’ve seen so far this year. (The contraction of authorized carriers among fleets with more than five vehicles jumped from 12% to 17%).

“Motive expects the current rate of contraction to continue, and more truck drivers could be unemployed as a result,” the company revealed. It also reported retail demand trended back downward post July 4, showing a 15% year-over-year decline.

“The freight recession may be a ‘detox’ from the pandemic’s artificial demand highs, as e-commerce growth is now back in line with pre-pandemic 10-year averages,” Motive concluded.

The telematics company says the carriers that are laser-focused on efficiency will emerge from the current freight recession the strongest.

“As consumer demand trends lower, retailers bring in inventory closer to demand, and rates continue to increase, businesses focused on operational efficiency and preserving cash are better prepared to weather the storm. In short, the focus for freight businesses right now and going forward has to be efficiency,” Motive concluded.

Spot market reaching ‘critical point’

A survey of small fleets and owner-operators by loadboard Truckstop and Bloomberg Intelligence suggests those relying on the spot market for loads are reaching a “critical point” due to declining rates and higher costs.

“We remain optimistic that rates are near a bottom and poised to rise with a return to more normal seasonal trends and inventories,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “Uncertainty about when rates will recover is making it increasingly more challenging for truckers to operate as independent carriers in the face of lower demand.”

The Q2 survey found that: more owner-operators are likely to be squeezed out by poor spot market conditions combined with rising costs; carriers are split on where spot rates are headed following an average 19% decrease in Q2, with 39% expecting rates to improve in the next three to six months and 24% seeing a decline; and 55% of respondents reported taking fewer loads than the same period a year ago, with 10% of respondents saying they plan to leave the industry in the next six months.

Is the spot market finally improving?

Looking at more recent spot market data from the week ended Aug. 4, Truckstop sees some subtle signs of improvement. The total broker-posted rate in the Truckstop system rose for the first time in 10 weeks, buoyed by reefer demand with a more modest gain for dry van loads.

“Given that the principal strength in rates was in refrigerated, it appears that the shutdown of Yellow Corporation did not have any major impact on the spot market – not surprising given Yellow’s focus on LTL,” Truckstop and FTR Transportation Intelligence reported. “The recent surge in diesel prices might have been a more significant factor. While modest, the increase in total spot volume was the strongest since April in a week not distorted by either the rebound from a holiday or the International Roadcheck event in mid-May.”

The Market Demand Index, which compares load and truck postings, rose to its highest level since the end of June as the rise in spot load postings combined with a “notable decrease” in truck postings.

Trouble brewing for automotive truckers

A new report from analyst DBRS Morningstar warns of trouble brewing for the Big 3 Detroit automakers, GM, Ford, and Stellantis, as they square off with the United Auto Workers (UAW) union at their plants. The car makers and union are far from agreeing on contract terms, and strikes at these auto plants can’t be ruled out.

Negotiations could be hampered by headwinds such as high inflation, rising interest rates and cost of living, job security as the industry shifts to EV production, and new leadership for the auto manufacturers and UAW.

“The confluence of these factors suggests a perfect storm brewing around the current negotiations, with the outcomes (possibly including a strike against one and conceivably all of the companies involved) potentially resulting in significant financial costs for these auto manufacturers,” wrote Robert Streda, senior vice-president, diversified industries with DBRS Morningstar.

ACT Research improves equipment outlook

But let’s end this week on a positive note, shall we? ACT Research says it is bumping its trucking industry forecast higher based on rising economic expectations. The industry analyst pushed up its forecast for Classes 5-7, Class 8, and trailer output for this year and next.

It says economic expectations for this year have improved, and with them more support for Class 8 trucks that will result in a shallower “trough” than initially expected. This is teeing the industry up for stronger demand into 2025, ACT says.

“With the economy gathering momentum into the second half of 2023, and with supporting backlogs in place, the risk to build rates into year end is now essentially in the rearview,” opined Kenny Vieth, ACT’s president and senior analyst. “While the 2024 forecasts have risen, they continue to anticipate slowing into next year, as pent-up demand for the Class 8 and trailer markets will be largely consumed by the end of this year amid strong fleet growth in the weak 2023 freight demand environment.”

He concluded: “An improving economic outlook is not a panacea to cure the freight industry’s sloshy capacity situation. A less-bad freight market in 2023 and rising 2024 economic expectations are at least helping to boost one side of the supply-demand imbalance with which truck and trailer buyers are currently wrestling. Adding even more new trucks into an already overcapacitized market risks keeping capacity looser for longer.”

Leave a Reply