Motive’s first ever Holiday Outlook Report paints a fairly grim picture of the trucking conditions, as higher fuel prices and soft freight squeeze truckers.

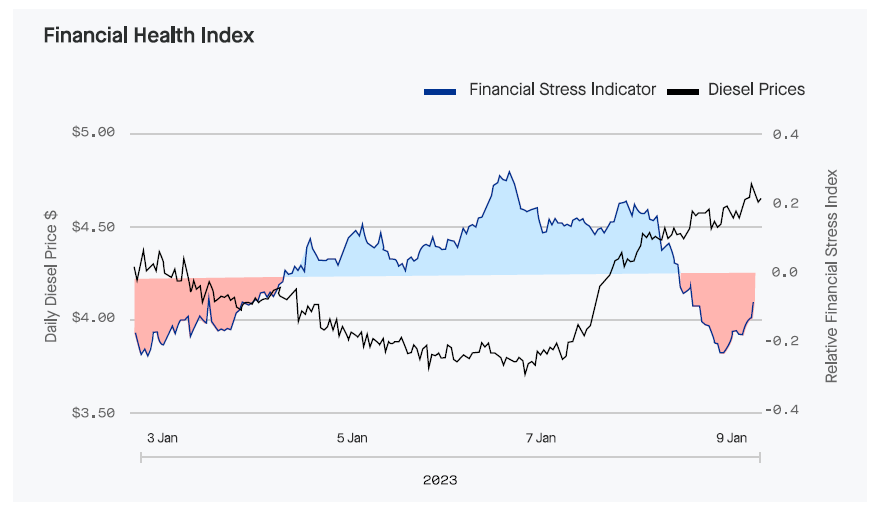

Presenting the report at a press event at the American Trucking Associations (ATA) Management Conference & Exhibition, Hamish Woodrow pointed to a strong correlation between rising diesel prices and financial stress for carriers.

“Financial stress and diesel prices are tight correlated,” he said, noting diesel prices have risen 18% since July in the U.S., and as much as 25% in California and 24% in Texas. When this happens, Motive sees a corresponding rise in financial stress measured by the number of payment delays by carriers.

For every 50 cents diesel prices rose in 2023, Motive saw a 30% increase in companies’ financial stress, particularly among smaller carriers.

“In 2023, we’ve experienced reduced consumer demand and an oversupply of capacity, which have shrunk and restrained the market,” the report says. “It’s expected that the trend will continue into Q4 and early 2024, so carriers should adjust their plans accordingly.”

This has also shown up in the form of carrier exits. “The number of carriers exiting the market increased in September,” according to the report, “moving back toward the record highs seen in Q2 and highlighting that the decreases last month were likely an anomaly versus signs of a changing trend. At the same time, new carrier starts saw a 10% drop.”

But if you’re looking for good news, driver churn has slowed in the third quarter compared to the same period last year. Only 14.9% of drivers changed jobs in the quarter, down 5% year over year.

Motive also examines the frequency of commercial vehicle visits to retail distribution centers, which it has geofenced, and can from this draw conclusions on retail inventory management. Motive advises fleets to anticipate delayed inventory ramp-ups, as retailers are being cautious about replenishing inventories.

Motive’s Big Box Retail Index was down 18% at the beginning of the year and has stayed below last year’s levels all year. However, it climbed back to within about 7% of last year’s levels in September.

“Retailers continue to be risk averse,” said Woodrow. “Nobody wants to end the year with a ton of inventory coming out, so it’s hard to predict demand right now. There’s so much uncertainty out there.”

The report also looked at safety and found collisions are at their highest on Dec. 23, even though traffic is down. This can be blamed partly on bad weather (last year Dec. 23 saw rain and snow) and perhaps also because drivers are rushing to finish up their work before the holidays. On Dec. 23, there were about 50% fewer miles driven in Motive’s network compared to the average December day, but collisions were up 150%. Hours of service violations were also noticeably higher in mid-December than at other times of the year.

The report concludes with some predictions for the holiday season and into 2024. Motive predicts: the trucking market’s contraction will continue; cost and demand volatility will continue into 2024; fewer people will seek to change jobs; retailers will continue to operate learner with less inventory; and efficiency will be the key to success for carriers.

Leave a Reply